Or, How I Learned to Love The Common Red Flags of Stonkiness

Here’s what to watch for when the financial world starts throwing frat-party energy:

- “Investments” That Do Absolutely Nothing Some assets don’t create value, generate revenue, or have any reason to exist beyond pumping and dumping. Their pitch? “It worked before, so it’ll work this time”” Spoiler: It won’t. If the whole formula relies on OPM, it’s probably some kind of pyramid scheme.

- The Leverage Fanatics Leveraged ETFs, crypto plays, and real estate are the realm of the MOAR crowd—more risk, more leverage, more inevitable regret. If the pitch is “you’ll make money faster,” they usually mean “you’ll lose it faster.”

- Pump-and-Dumps, Vague Disruption, and Concepts Without Clarity Beware the empty promises of financial raccoons rummaging through the trash for a quick buck. If someone’s hyping a “revolutionary” idea that’s all sizzle and no steak, it’s time to step away. Bonus cringe if they GUARANTEE returns (nobody real does this, ever).

- Money Divorced From Reality Luxury car parades. Splashy events dripping with wealth. “Degen” money flowing at Art Basel, NYC holiday parties, or LA influencer blowouts. When the champagne is endless, the bubble bursting usually isn’t far behind.

Déjà Vu All Over Again

This isn’t the first time markets have gone full clown town. Let’s hop in our time machine:

- 2020–2021: Remember growth stocks, SPACs, and the ICO/shitcoin boom? Everyone was “going to the moon” until the rocket fuel ran out. Davey Degen had a buddy at a vertical tomato farm about to SPAC. The hype was unreal—“triple your money and move to Puerto Rico!” That was from their CFO. Yeah… the SPAC fell apart, and the stock is now worth zero.

- 1999–2001: The tech bubble, eyeball stocks, and more SPACs. Davey recalls fondly crushing his high school stock market contest by picking companies with cool names. The QQQs drew down 90%, and the house of cards collapsed.

- The Roaring 1920s: Flappers, jazz, and way too much speculation. The “shoeshine boy” story (where the kid shining your shoes gives stock tips) became lore as the ultimate cautionary tale.

The Moral of the Story

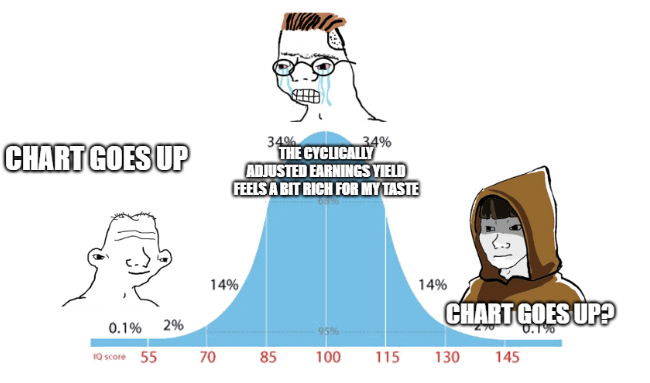

You don’t have to be the first lemming to jump. Here’s how to keep your head when everyone else is losing theirs:

- Stick to a Process Do the homework. Look for companies with real upside and solid fundamentals. It’ll protect you on the downside. If you’re relying on the next guy to buy your bag, it’s a bagel waiting to happen. Cash flow rules everything around you.

- Watch What the Pros Are Doing Sure, even professionals can get caught up in hype cycles, but they’re less likely to YOLO into disaster. Use tools like Motu to filter out the garbage and stay grounded.

- Be Patient You don’t need to catch every wave. Be cool with missing the FOMO-fueled upside if it means you’re ready to pounce when things inevitably come crashing down.

Final Thoughts

When the market feels like a house party spiraling out of control, remember: the grueling hangover is coming. Stick to the basics, stay skeptical, and don’t let your inner degenerate drive your financial decisions. You’ll thank yourself when the dust settles.