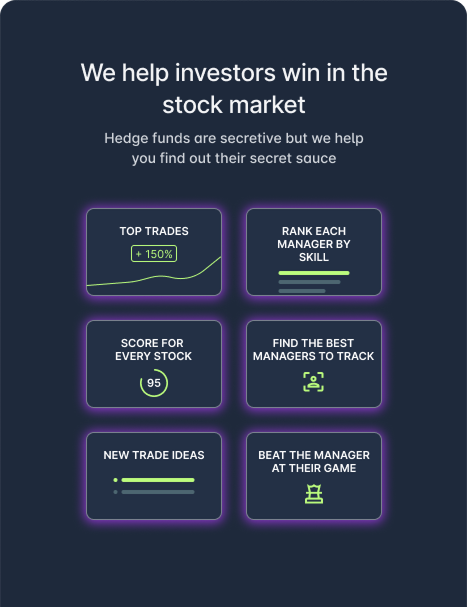

Learn from top investors using AI-powered insights

Discover the trades of the world's best investors and put them to work for you

Learn from top investors using AI-powered insights

Discover the trades of the world's best investors and put them to work for you

A modern, AI-Driven experience for analyzing the pros and their picks

MOTU is built for you. Its AI and big data wrapped in an eye-catching, easy to use interface.

Up your game by tapping hedge fund managers to be your personal mentors.

While you wait, get up the curve

Explore market trends, institutional analysis, and expert tips to sharpen your strategy

Do Pass-Through Fees Suck? Only for Investors

The Sneaky World of Pass-Through Fees Balyasny Atlas (Around $30B AUM) fund made 15.2% in 2023. Great for them. Their investors must have been pretty happy. Not really. They only got 2.8% back. Waat? Pass-through fees are killer. What Are Pass-Through Fees? Pass-through fees are essentially expenses hedge

Juicy MOTU Stocks Kicking off 2025

Top 5 Stock Picks Big Investors Are Hyping in Their Latest 13F Filings Ever wonder what stocks are catching the eye of Wall Street’s biggest whales and brightest investors? 🤔 Every quarter, hedge fund superstars dish out their 13F filings, revealing what they’ve been buying (or selling) recently. We’

Hedge Funds: Good or Evil?

Hedge Funds: Good or Evil? Hedge funds have a certain mystique. The managers behind them often appear on magazine covers, live in jaw-dropping mansions, and seem to have exclusive VIP passes to the world’s best parties. It’s no wonder people are fascinated by them. Yet some folks look

How to Use Motu to Find Stocks

Let’s face it: trying to pick winning stocks can feel like sorting through a bargain bin of VHS tapes—tedious, overwhelming, and probably a waste of time. On one hand, you’ve got your boomer uncle pushing “hot tips” from the financial pages of 1997. On the other, Tok

Are Hedge Fund bros even worth the follow?

Maybe Not. But then again... Some might say following hedge fund stock picks is a losing game. After all, these big-name funds often fail to outperform a simple S&P 500 index. S&P 500 vs Hedge Fund Returns Since 2011 - The Big PictureSource: Arbor ResearchThe Big

Where Did All The New Hedge Funds Go?

Hedge funds have long been the playground for the sharpest minds in finance, where the best and brightest dream of starting their own shop, selling levered beta for Gucci prices, and retiring to the Hamptons. But lately, the dream feels more like a nightmare, thanks to the rise of the

Learn actionable insights while we prepare the ultimate platform for your success

Powered by industry experts to simplify data-driven investing