Hedge funds have long been the playground for the sharpest minds in finance, where the best and brightest dream of starting their own shop, selling levered beta for Gucci prices, and retiring to the Hamptons. But lately, the dream feels more like a nightmare, thanks to the rise of the Three-Headed Pod Monster: Balyasny, Citadel, and Millennium.

These juggernauts are swallowing the entrepreneurial spirit of many a middling hedge fund analysts whole, and if you’re not bucking the trend, you'll end up bowing at the feet of Dimitri, Ken, and Izzy, staring down the barrel of a 6% drawdown death sentence.

The Pod Power Paradox

Here’s the ironic twist: Ken Griffin himself, the head honcho of Citadel, recently hinted that the pods might have peaked ($ big time paywall). Yes, the same pods that dominate the landscape, like his own cash factory. He even suggested that the future prospects of his own business aren’t as shiny as they were a few years ago.

What gives? Is this reverse psychology? A subtle flex? Or a sign that even the top dogs are scratching their heads about where things are headed?

From Consolidation to Creation

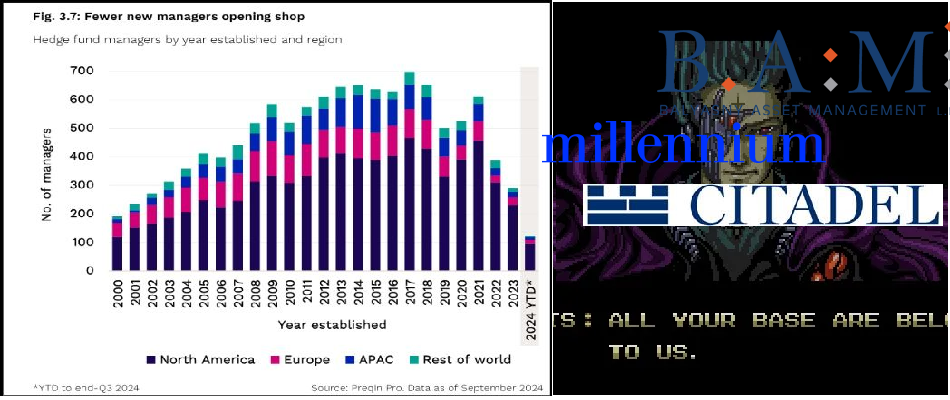

Markets are cyclical, and so are hedge fund launches. History shows us that when competition dries up, it doesn’t stay that way for long. Consolidation is the prelude to disruption. When the big players tighten their grip, it leaves cracks for new talent to slip through. Big things come from small beginnings.

At Motu, we track new hedge fund filings every quarter with our proprietary Hedge Fund Index, and guess what? Most new launches are coming from within the Hydra itself—spinoffs and alumni striking out on their own.

The Opportunity Ahead

Yes, the Three-Headed Pod Monster looms large, but that doesn’t mean all hope is lost. In fact, it’s the opposite.

- Success Begets New Beginnings

The pods have built empires, but their dominance is sowing the seeds for the next wave of innovation. It’s a classic case of innovators dilemma creating opportunities for the scrappy and ambitious. - The Entrepreneurial Spirit Lives On

For every analyst feeling crushed by the weight of the pods, there’s one quietly plotting their escape. The future belongs to those who can adapt, innovate, and capitalize on the gaps left by the giants.

Final Thoughts

The rise of BCM might feel like the end of the line for hedge fund independence, but it’s really just a new chapter. The pod era will pave the way for a fresh wave of funds, ideas, and competition.

To the health of the industry: may the next generation of hedge funds rise to the challenge and thrive in the cracks left by Hydra. The three heads may reign for now, but the entrepreneurial spirit isn’t dead—it’s just waiting for its moment.