The Sneaky World of Pass-Through Fees

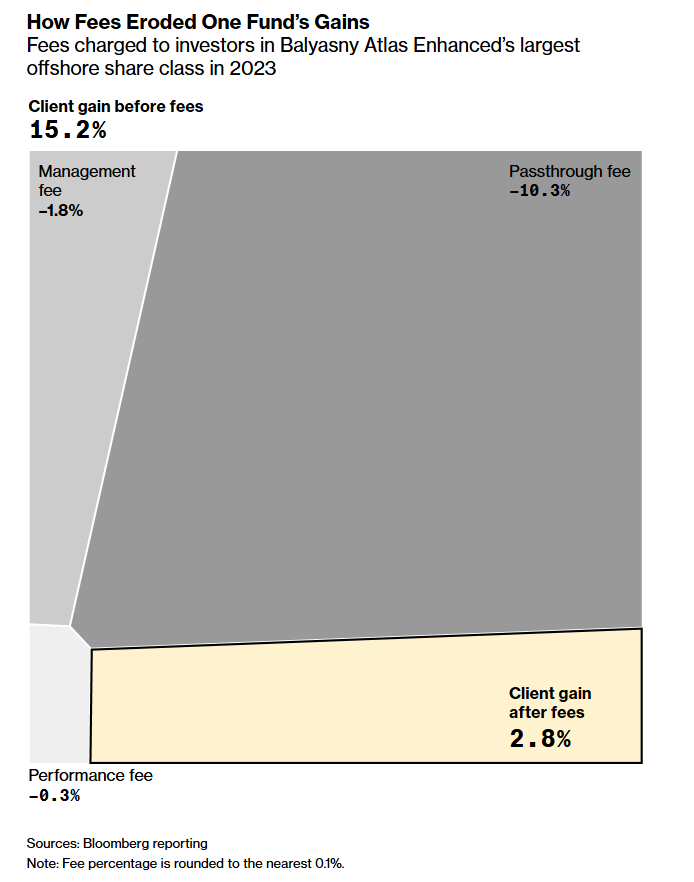

Balyasny Atlas (Around $30B AUM) fund made 15.2% in 2023. Great for them. Their investors must have been pretty happy.

Not really. They only got 2.8% back. Waat?

Pass-through fees are killer.

What Are Pass-Through Fees?

Pass-through fees are essentially expenses hedge funds offload directly to investors, rather than covering them within the standard management/performance fees. Think of them as “a la carte” charges for things like research, travel, legal bills, or extra admin costs. Investors just pay it and that is why there is a gap between what the fund made in the market (Gross Performance) and what the investors got back (Net)

Why Do They Exist? Hedge funds argue that certain variable costs (specialized data sources, expert consultants, occasional private-jet “due diligence” trips) shouldn’t be lumped into the base fee. Instead, they’re passed through to investors on a line-item basis. Neat for the hedge fund, not for their LPs (investors).

Why This Matters and Why Investors are Taking Notice

This feels like investors get the bill for everything. Ever get your phone bill and see 15 line items you don’t recognize, like “Regulatory Recovery Fee” and “Network Admin Surcharge”? That’s kinda how pass-through fees can feel. You might think you’re paying a straightforward 1.5% management fee, but then you discover an entire buffet of hidden charges.

They can translate to Higher Net Costs: Even if the “headline” management fee looks decent, pass-through expenses can push your true fee burden higher than 2%—maybe even beyond 3%. Ouch. Talk about stealth mode.

They run the Risk of Overcharging: Some critics say pass-through fees can become a slush fund for unnecessary spending. The more liberal the manager is with “legitimate” pass-throughs, the bigger the investor’s bill.

Why Are Hedge Funds Doing This?

Bloomberg notes several reasons pass-through fees remain (or are becoming) popular:

- Fee Compression Pressure

As “2 and 20” becomes less palatable, some funds advertise lower headline fees. The catch? They offset that revenue dip by charging pass-through expenses. It’s like saying, “We’re cutting the burger price by $1, but the fries are definitely not free.” - Specialized Research Needs

Many funds genuinely do require specialized data—like exclusive satellite imagery or private investigative work. They say these costs shouldn’t be spread across all investors if only certain strategies or deals require them. (Investors: “But we all get the bill anyway?” Manager: “Trust me, it’s worth it.”) - Regulatory Complexities

In some jurisdictions, it’s easier to itemize and pass along certain fees for compliance reasons, making them “legit” from a legal standpoint. But legal and fair aren’t always the same in the eyes of the LP (Limited Partner). - Market Demand

Big institutions—like pension funds or endowments—sometimes accept pass-through fees if the hedge fund’s performance record is strong. If you’re an investor with fewer options, you might just sigh and sign on the dotted line, trusting the manager to deliver alpha net of every possible charge.

How can you avoid pass through fees?

Follow the best Hedge Funds on Motu, of course. The higher the fees, the more sense it makes to use public filings and capture some of that Gross performance, and use all the value from fees, without actually paying for them.

Source:https://www.bloomberg.com/graphics/2025-hedge-fund-investment-fees/?embedded-checkout=true