Maybe Not. But then again...

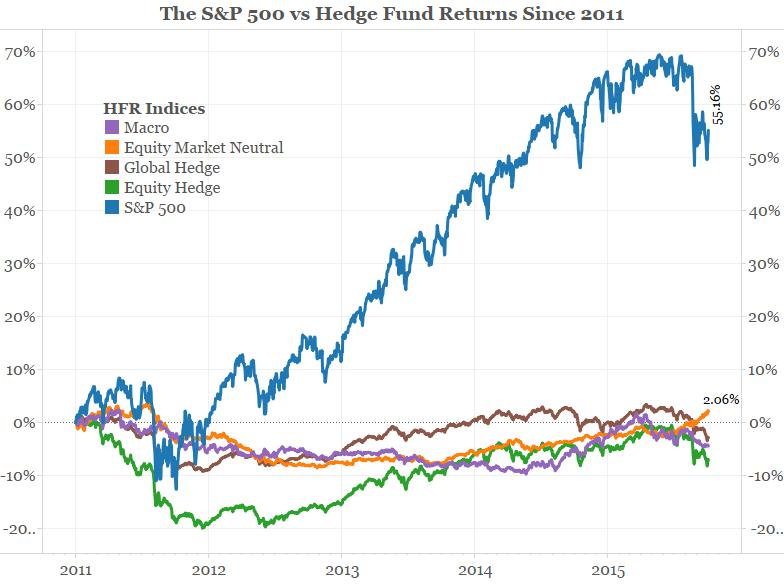

Some might say following hedge fund stock picks is a losing game. After all, these big-name funds often fail to outperform a simple S&P 500 index.

It’s easy to imagine they don’t know what they’re doing. But that’s not exactly fair. The truth is, hedge funds aren’t just picking stocks—they’re running a complex business. That changes the game.

Think of it like a pro sports team. A top-tier baseball franchise doesn’t just focus on having one star player; they’ve got to manage a whole roster, balance salaries, deal with player trades, hire coaches, and keep fans happy. All that overhead might weigh them down in the standings. But it doesn’t mean their star player can’t hit home runs. In hedge fund terms, that star player is their best stock pick.

What’s pulling them down?

- Diversification requirements: They must spread their money across many assets. Else, their investors - big pensions and endowments, would not write them a check.

- Risk management: They hedge against big swings, limiting gains on their best bets. This way they protect against big swings in the markets.

- Deal flow and overhead: Running a big fund with tons of analysts, data vendors, investors, trading partners, and tech costs money—and time.

- Large asset bases: Managing a huge pile of cash makes it harder to move quickly and exploit small opportunities. They must often "park" their cash in "safe" mega caps.

Hedge funds need to keep their business stable, and that often comes at the cost of raw performance. They are OK with that. Remember, Hedge Funds make money in two ways: Management Fee and Performance Fee. The larger a fund gets, the more they are keen to protect their management fees - a stable source of income that just depends on size, not performance.

But hidden behind all that complexity are genuine stock picks that, if isolated correctly, can outperform. Big time. These funds often hire Ivy League grads & top data scientists, use cutting-edge data, and have deep connections with banks and other investors. They have insights you won’t find by simply scrolling through Twitter or browsing a basic stock screener.

If the hedge fund is the baseball team, their best stock picks are like player “cards.” Just like you’d trade fantasy sports cards, you can look at hedge fund holdings and focus on their best assets—the ones that can knock it out of the park. The challenge is getting to those picks in time and making sure you’re not dragged down by all the extra baggage. That’s the sweet spot where hedge fund managers truly shine: identifying stocks that have a real shot at strong returns before everyone else notices.

Where does the manager add the most value?

- Spotting trends before they go mainstream

- Using deep research and exclusive data to pick stocks that outperform

- Leveraging connections to get into deals early, or going activist to create value

How do you tap into this wealth of expertise without the need to invest millions into an actual Hedge Fund? Enter Motu. Our platform slices through the noise and focuses on the essential insights—the “baseball cards” of the hedge fund world. We help you identify which stock picks are worth following, stripping away the overhead and allowing you to benefit from the fund’s best ideas, without taking on all the business burdens that come with running a giant hedge fund.

With Motu, you’re not just another spectator; you’re on the inside track to smarter investing.

Stay Tuned....